Solar Panels, A Fresh Perspective

9th January 2023

Author: Christopher. J. Parker

In our impromptu article series on energy challenges in the UK, it is time to consider methods of self-generated electricity. So far, we have discussed the limitations of Green Hydrogen restricting its uptake for domestic heating, the realisation of hotter summers, methods to support refrigeration systems, and how the energy crisis has unfolded in the country through policies and global events over the past two decades. Now we have a question to face. What are we going to do about it?

The Challenges

The national grid is one of the largest and most expensive peace time projects in the UK. It has serviced the UKs growing energy demand for the past 100 years, starting off with coal power stations next to the mines and pits of West Yorkshire, the addition of controversial nuclear power stations situated as far away from London as possible, to the latest installation of floating wind turbines far off the coast of Scotland into the North Sea. Regardless of the power source, it has been the National Grid that carried the electricity up, down, and across the country reliably. That last word, reliably, is now at risk.

The aging National Grid, as our energy provider, is facing serious challenges. In parts of the UK the grid has reached capacity, delaying urban expansion while the local grid is upgraded and expanded. The primary energy sources are at risk of drying up and sold at increasing prices, the causes of which are discussed in my previous article “How can we keep the lights on?” These factors have led to unprecedented plans to initiate strategic blackouts to maintain electricity in certain sectors according to a priority list should the supply drop. While we do not know what the priority list is now, we can be sure of the major impact a blackout will have on a business’ operation, and people’s lives.

It is for this reason why I have chosen to visit the topic of self-generated and stored power. It is the businesses and people that are decentralised (not dependent on the national grid) that will ride out the blackouts with minimal impact. Consider also, the cost of electricity in the UK has risen by 45% over the past year and shows no sign of stopping. That is a major increase in operational costs, a major increase that can be mitigated or avoided with self-generation and storage.

In terms of self-generation what is there? Three viable methods are available across the UK:

- Wind power

- Solar power

- Waterpower

Each of which have their own restrictions around installation and as much as I would like to discuss them all, solar power is the most accessible for UK businesses and domestic dwellings and the focus of this article. Perhaps the others will make a future appearance?

A sufficient area is needed to place solar panels and generate a meaningful quantity of power. The most common and ideal place is a roof as it is out of the way, and for the most part, free of obstructions. Certain buildings will, of course, use roof space for other mechanical equipment.

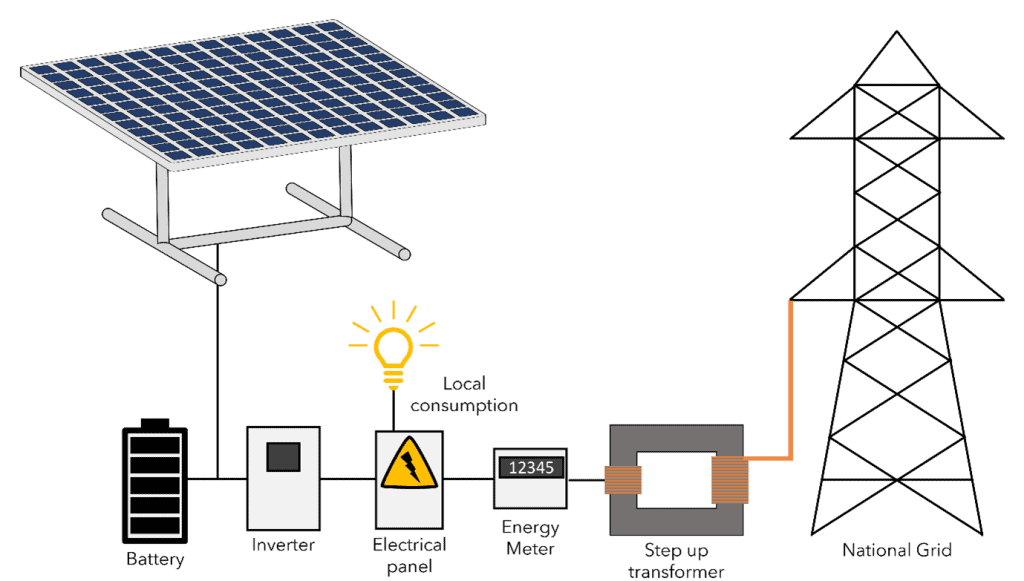

For energy storage there are a host of weird and wonderful mechanisms such as compressed air, molecular storage and gravity weights. But the most sensible, refined and likely solution is chemical battery storage. Batteries are constantly undergoing research and development to increase capacities and lifetime. Solar panels and batteries have undergone a resurgence as recently as 2017 when the initial costs reduced by 67% increasing the affordability of the technology. Modern solar installations go hand in hand with battery storage, enabling the use of energy during low or no periods of production.

The Solution

The design and cost of solar array installations have changed over the past decade. Once, installations were “use it or export it” with generous Government backed levy payments for each unit of energy produced. As the Government backed schemes have changed to lower levy payments for what is exported rather than what is produced, at a value lower than National Grid electricity, battery storage has become a key component of system installation. The battery enables the cheaper and clean solar energy to be used out of production hours, improving the emissions of operation and reducing operational costs.

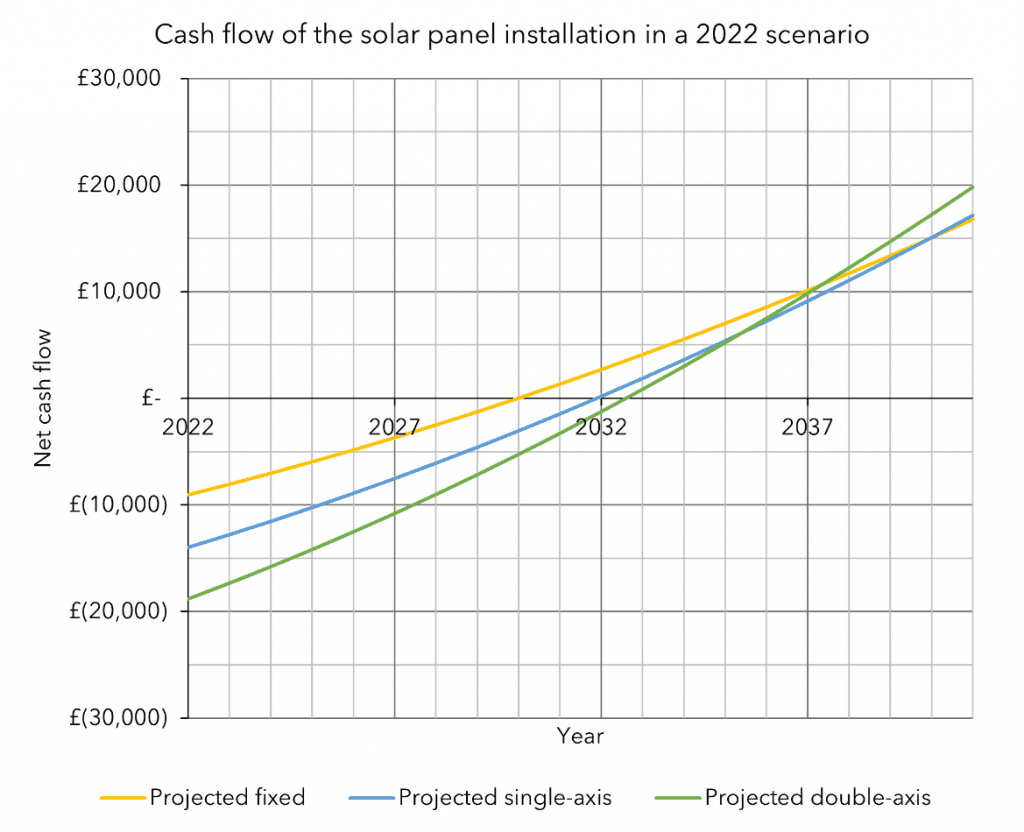

Conversations about solar panels always navigate to unproven financial prospects, therefore, I created an illustration of a solar arrays’ lifetime cost benefit. An example installation for a 40 m2 array in Liverpool, my favourite take out when studying, has been simulated for annual energy production.

| Longitude | -2.98° |

| Latitude | 53.40° |

| Roof top area | 40 m2 |

| Panel bearing | 150 |

| Panel pitch | 45° |

| Rated maximum power | 330 W |

| Panel dimensions | 1990 x 991 x 7.5 |

| Installed capacity | 6.6 kW |

| Panel efficiency at STC | 19% |

| Thermal coefficient | -0.32%/K |

Simulated Annual Energy Production accounting for temperature variations and cloud index:

- No tracking 6 043 kWh

- Azimuth (bearing) tracking 7 291 kWh

- Elevation (Sun’s height) tracking 6 155 kWh

- Dual tracking 9 039 kWh

Clearly, the more complex tracking panels produce the greatest amount of electricity for use and/or export, but how does the cash flow look? Installation and maintenance costs are readily available from companies in the solar panel industry and have been applied for 2010, 2017, and 2022 scenarios.

The cash flow review of each year all shows the same long-term trend. A profitable installation at the end of life while eliminating at least 48 Tonnes of equivalent carbon dioxide by the end of life. That’s 26 flights from London UK to Sydney Australia, or 2.5 Apollo 11 Mission launches, all from a 40 m2 roof!

Where financial prospects are concerned, if the business is not generating revenue through the sale of energy, the investment will come from the company’s profit and therefore, should be considered a long-term business reinvestment. Provided the installation has a net positive value greater than or equal to 0 at the end of its life, it is absolutely a worthy investment.

Look beyond simple payback and consider the following accounting figures to weigh the value of such an investment. Each label is another method of measuring the value of a project and should be consulted for any investment.

Table 1 – Accounting matrices for the 2022 installation scenarios.

| Installation | Payback | Discounted Payback [5%] | Average Rate of Return | Net Present Value | Internal Rate of Return | Benefit Cost Ratio | Profit Investment Ratio |

| Fixed | 9 | 12 | 13.4% | £5,867.79 | 10.3% | 0.59 | 1.59 |

| Single-axis | 11 | 16 | 10.7% | £4,016.60 | 9.5% | 0.27 | 1.27 |

| Dual-axis | 12 | 17 | 9.9% | £3,478.31 | 8.7% | 0.17 | 1.17 |

Conclusion

Solar panels have been reviewed in the past by businesses and households alike. Most have passed on the opportunity due to limited initial capital, low priority or strict demands for low payback periods. However, as priorities have changed and the environmental and social risks become more prevalent, the subject of solar panels must be revisited with fresh goals and mindsets. The goal of solar panels is not necessarily to produce profits for the business or household.

The goals are:

- To reduce reliance on the National Grid

- Secure a supply of electricity in the event of blackouts

- Tangibly reduce the environmental impact of the business or household

As illustrated, based on today’s installation and energy costs, a solar array system can potentially provide profit covering CAPEX and maintenance, and reduced reliance on the strained National Grid. If you have any questions on this article or wish to open a dialogue about solar power potential, please feel free to contact us. For a direct conversation please see my email address: Chris@wave-refrigeration.com